Delivering everything you could ever want or need in an ATM application

A highly scalable, multi-vendor ATM application with a powerful set of features offering a rich set of transactions and services from simple cash dispense to full integration into your digital banking environment.

%20(1).jpg)

%20(1).jpg)

Step into the future of self-service

NDC Enterprise provides a bridge from legacy applications such as ANDC to a modern digitally enabled platform, ready for future innovation, yet providing a simple deployment of traditional ATM transactions. This gives our customers a choice of determining how quickly or slowly they want to evolve their ATM network.

From simple cash dispense to a range of over 100 banking services, NCR Atleos’ NDC Enterprise delivers a platform with the agility and interoperability capabilities to unlock the best experiences for your customers and give them the experiences they expect.

Transform to a truly digital-first channel with the power of physical fulfillment

Scalable from the largest to the smallest ATM networks

NDC Enterprise is operating successfully in large ATM networks of thousands of ATMs and in small community banks with less than 50 ATMs. It is fully scalable and offers the broadest standard transaction set on the market, with the capability to rapidly introduce more.

One supporting toolset

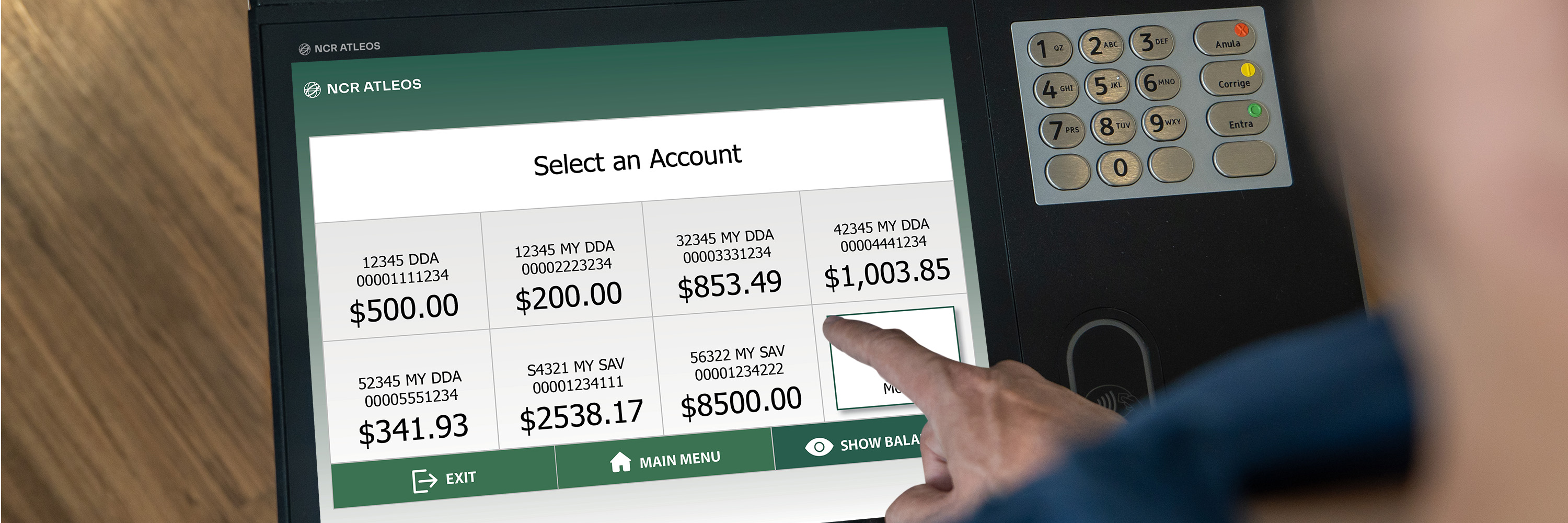

NDC Enterprise’s powerful tools give customers more control of their consumer flow and offers the ability to change screens, logos. This enables the segmentation of services and transactions offered in different locations and even at different times of the day, reducing costs by managing the transaction flow and user interface through the enterprise server.

Proven reliability and performance

NDC Enterprise builds on the success and robustness of its predecessor, ANDC, which has been the number one ATM software product for over 20 years. With over 1,200 customers, NCR Atleos learned a lot from the very large deployed base gained over the years, making NDC Enterprise a highly reliable and trusted solution, adaptable to any customer use case and network environment.

One software application that spans ATM, ITM and enhanced self service

However you want to serve your customers, NDC Enterprise is there for you. From conventional ATM transactions to next-generation, digital-first services, NDC Enterprise removes the need for switch changes by adding adjunct digital transactions that can utilize a connection to core banking or third-party partners. With NDC Enterprise, you can deliver a broader range of banking services while supporting interactive and collaborative services, such as video-assisted banking, through ITM.

.jpg)

Support for the latest consumer experiences

Attract and retain more consumers with a new interface and elevate your brand with a user experience that reflects your other banking channels. Through tight alignment and integration with NCR Atleos hardware; contactless; cardless; direct currency conversion (DCC); cash recycling; check and cash deposit; simplified content publishing for both NCR Atleos and multi-vendor ATMs; fast deployment of new transactions at the ATM and many more innovations are supported.

%20(1).jpg)

A foundational part of the NCR Atleos ATM platform

Pre-integrated with a wide range of vital ATM Services such security, management, marketing, terminal handling, interactive services and more, NDC Enterprise’s modern architecture and integration capabilities enable shared services across the enterprise.

Why NCR Atleos?

in Europe, Middle East, Africa and Asia*

of routine branch transactions can now be migrated to self-service

with NCR Atleos presence for over 50 years

Powering over 50% of ITM terminals**

* NDC 2023

** NDC 2024